- 2024-01-10 06:03 PM

- Admin

Ready-made features set for e-money and cards under your brand. Use our proven toolkit for handling account and card creation, config and controls, and transaction management. It’s all built to run via APIs in third party UX front ends.... Register Now

Your Text Here...

We offer specialised payment device that connects via Bluetooth to a tablet or smartphone app, allowing you to take secure payments in-store, on the go or wherever you do business. Blockchain Bank collects your card, bank and bill payments in one place. Connect with your phone number and get a full overview of your total economy no matter how you pay.

A digital wallet refers to an electronic device that allows an individual to make electronic transactions. This includes online money transfers with any digital device or using a smartphone to purchase something at a store. An individual’s bank account can also be linked to the digital wallet. A customer must register with the provider, and may have to complete a full KYC (Know Your Customer) process in order to use an E-wallet.

Through a range of online banking payment methods – Virtual accounts/IBAN Money wires, SEPA, Faster Payments, Direct Debits, Sepa Direct – even customers who do not own a credit or debit card are also given the option of making secure online payments. This increases the conversion rate and customer satisfaction. Blockchain Bank offers different online bank transfer options on a single platform, which only has to be integrated into your payment page once, a process which is very easy to complete.

Blockchain Bank gateway services provide a flexible solution to support your online business. With diverse, innovative features and customized solutions, we make sure our clients and their end-customers can conduct online payment transactions using any digital device. With a quick and easy integration, you’ll have a seamless, highly-converting, and secure checkout.

Your Text Here...

Free, quick and easy to apply for with no credit checks or bank account required. Apply for your Business Merchant Account

The initiative is building and designing banking software that gives users a seamless banking experience. In this context, the administrator and the end-user are our target audiences. That’s why we have also designed the software to allow administrators to manoeuvre through the entire platform easily.

You can serve your business associates, friends and family members from anywhere, anytime, regardless of their location.

Borg Bank gateway services provide a flexible solution to support your online business. With diverse, innovative features and customized solutions, we make sure our clients and their end-customers can conduct online payment transactions using any digital device.

View Details

International Money Transfers at a Fraction of Bank Wire Costs

View Details

With the Borg Bank Card Coin You Can Send and Receive Money Fast and Easy Across The World

View DetailsYour Text Here...

Your Text Here...

Investments

Users

Awards

Satisfied Clients

Don't Take Our Word For It. Real Customers Sharing Real Experiences

We don’t require your business to get its own bank license as a regulated financial institution. Our decentralized Blockchain Bank's deliver to you an immediately usable online banking package of features which include built-in compliance. One important aspect of this is that your business does not need to handle sensitive financial data such as credit card numbers: our technology segregates this data securely while ensuring you can still customize the design and content of the user experience of financial workflows within your private label bank applications.

No prior banking or payments technology experience is needed in your team. Blockchain Bank's mission is to make adding financial features to your applications as easy as plug-and-play. So we’ve done the heavy lifting on both the technology and regulatory complexities of building and running embedded finance, allowing you to focus on the innovative use cases you’re going to bring to market. The sky’s the limit!

With Blockchain Bank, you can go to live transactions in your private label bank app within 24 hours! Because we’ve already taken care of putting together all the parts you need to integrate powerful financial features into your turn-key bank application. Development time only depends on configuration, testing, and integration with your application stack in case we create a new bank with your name of choice. When you purchase one of our ready- made banks, this allows you to get your new bank applications into production in a matter of hours, compared to the weeks, months or even years that it takes for businesses working with banks and piecing together compliance, anti-fraud, and other required elements by themselves.

Yes! Your private label banking platform offers all aspects of sensitive customer information across onboarding, authentication, and transaction processing, which are handled securely through the embedded security system.

Yes! Compliant financial processes for know-your-customer (KYC) and know-your-business (KYB) when registering new users with your bank. Easy to manage offboarding if users leave.

We implement into your online banking platform robust regtech infrastructure, including built-in anti-fraud monitoring, safe financial presets appropriate to your business model, and continuous compliance updates, so you can focus on building your bank business.

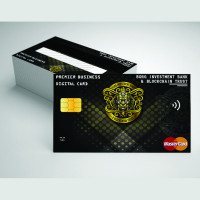

Yes! You can allow businesses in your banking platform to create payment cards that empower their employees to spend safely, embedded with a branded digital experience of your bank.

Yes! You can create custom designs for virtual and plastic payment cards. All aspects of financial UX are yours to plan, so your clients associate their new fintech powers with your bank brand.

Yes! You can generate and connect credit accounts instantly, hold segregated balances and budgets, fund payment cards, and transact programmatically.

Yes! You can allow businesses in your banking platform to create payment cards that empower their employees to spend safely, embedded with a branded digital experience of your own bank.

Yes! You can give freelancers, creators and influencers the financial tools they need to manage cash flow, make payments and reduce admin so they can focus on growing revenue. You can boost digital user engagement and loyalty in your freelancer or contractor online banking platform by embedding valuable financial features within the context where they find work and earn money directly from your banking website.

Blockchain Bank gateway services provide a flexible solution to support your online business. With diverse, innovative features and customized solutions, we make sure our clients and their end-customers can conduct online payment transactions using any digital device. With a quick and easy integration, you’ll have a seamless, highly-converting, and secure checkout.

Yes! Through Blockchain Bank You Can Make International Money Transfers at a Fraction of Bank Wire Costs.

Yes! You can start earning passive income through real estate investments, starting at $50 per month. Believe it or not, you don't need millions, or even hundreds of thousands to invest in real estate. Nor do you need to commit to the complex responsibilities that come along with managing properties. Blockchain DigitalCity is a tax exempt Real Estate Community and online platform where you can invest in shares of rental homes and vacation rentals without taking on the responsibilities of property management. In other words, you won’t be in charge of fixing freezers or managing noise complaints, but still get to generate regular income and diversify your portfolio. Backed by Blockchain DigitalCity Bank & Capital Trust, the Blockchain DigitalCity project has a low investment minimum of $50, so you don’t have to be a billionaire to invest like one. Rental property investing made simple! Blockchain Bank is making real estate investing accessible to new investors looking to dabble in the real estate market without breaking the bank. Investors can invest anywhere from $50 to approximately $20,000 per house, making real estate investing more accessible to a wider range of investors. Real estate investing for a small fraction of your money! With several million in private funding from a group of investors, including Blockchain Bank and other millionaires, Blockchain DigitalCity is a one-stop shop for making informed rental property investments. You can browse investment properties directly on their website: https://www.blockchaindigitalcity.com/

Yes! With the Blockchain Bank Card and the BBC Stable Coin You Can Send and Receive Money Fast and Easy Across The World.

Yes, Blockchain Bank does support multiple languages and your admin panel can be customized to the various languages of your choice.

Sure! All our system data can be transported and used in external software systems. Our platform also can easily synchronize user data with third-party systems under your authorization. This feature was designed to ensure that our clients do not have to start all over again, adding their data to a new platform.

Yes! Our platform is designed to allow multi-currency transactions, including transacting in cryptocurrencies.

Yes! Blockchain Bank allows for multiple administrator access to enable you to manage your client base effectively.

You do not need to build a new mobile application from scratch, as part of what we offer is a total package! We understand how many mobile phone users have increased globally, and to position you globally, we have created a mobile application that you can edit and design to your suiting.

To find out the cost of our services, please go to the demo page, fill up the information, and an email will be sent to you detailing all of the information about our pricing.

Blockchain Bank API is designed to support and integrate third-party applications. You can design your apps to connect with the Blockchain Bank system. For further information on integrating your apps around our systems, please get in touch with us.

Yes, Blockchain Bank has features that support debit card functionalities. If you wish to integrate any specialized card program, contact us to help with the full integration, as the platform is designed to integrate any card platform that was not originally designed into it.

No, Blockchain Bank does not collect additional charges from our clients as the traffic on the software increases.

Blockchain Bank is a global company with a wide reach in over 60 countries and can provide AWS server locations worldwide.

Any business managing clients' funds or functioning as an intermediary between transactions can use the Blockchain Bank platform. These can be banks, Electronic Money Institutions, Payment Institutions, Asset and Trust Managers, Credit Unions, and Crypto Traders—as long as you want to establish your own financial institution with us, you are eligible.

Inspiration in every article

© Borg Investment Bank & Blockchain Trust © All Rights Reserved - Borg Investment Bank & Blockchain Trust